The landscape of television consumption in Russia has undergone a dramatic transformation over the past decade. With the rise of internet infrastructure and changing viewer preferences, IPTV Russia services have emerged as a dominant force in the entertainment industry. This comprehensive guide explores everything you need to know about Russian internet television, from the leading providers to legal considerations and technical requirements.

IPTV Russia represents more than just a technological shift – it’s a cultural revolution that has democratized access to diverse content while offering unprecedented flexibility to viewers across the vast Russian territory. Whether you’re a Moscow resident looking to cut the cord or an expatriate seeking Russian content abroad, understanding the IPTV landscape in Russia is essential for making informed entertainment choices.

The Russian IPTV market has grown exponentially, with over 15 million subscribers as of 2024, representing a 300% increase from 2019. This growth reflects not only improved internet infrastructure but also changing consumer preferences toward on-demand, personalized viewing experiences. Major telecommunications companies have invested billions of rubles in IPTV infrastructure, making Russia one of the fastest-growing IPTV markets globally.

Table of Contents

What is IPTV Russia? Understanding Internet Television in Russia

Definition of IPTV Russia Services

IPTV Russia refers to Internet Protocol Television services specifically designed for and operating within the Russian market. Unlike traditional broadcasting methods that rely on terrestrial, satellite, or cable transmission, Russian IPTV delivers television content through internet protocols over broadband connections. This technology enables viewers to access live TV channels, video-on-demand content, and interactive services through their internet connection.

The fundamental difference between IPTV Russia and conventional television lies in the delivery mechanism and user control. Traditional Russian television broadcasts content according to predetermined schedules, forcing viewers to adapt their routines to programming timetables. In contrast, IPTV Russia services offer time-shifted viewing, allowing users to pause, rewind, and record live broadcasts. This flexibility has revolutionized how Russian families consume entertainment content.

Russian IPTV services typically operate on a managed network infrastructure, ensuring quality of service and content protection. Major providers like Rostelecom and MTS maintain dedicated networks for IPTV delivery, separate from general internet traffic. This approach guarantees consistent streaming quality and reduces buffering issues that might occur with over-the-top streaming services.

The technology behind IPTV Russia involves several key components:

- Content acquisition and encoding systems that convert traditional broadcast signals into IP-compatible formats

- Middleware platforms that manage user interfaces, electronic program guides, and interactive features

- Content delivery networks (CDNs) strategically positioned across Russia to minimize latency

- Set-top boxes or smart TV applications that decode and display IPTV content

- Billing and subscriber management systems that handle user accounts and service provisioning

Evolution of IPTV in Russia

The journey of IPTV in Russia began in the early 2000s when major telecommunications companies recognized the potential of IP-based content delivery. Rostelecom, Russia’s largest telecommunications provider, launched its first IPTV trials in 2005, initially serving select Moscow neighborhoods. The service gained traction slowly due to limited broadband penetration and high equipment costs.

A significant milestone occurred in 2010 when the Russian government announced the “Digital Russia” program, allocating substantial funding for broadband infrastructure development. This initiative accelerated IPTV adoption by improving internet connectivity in previously underserved regions. By 2012, Russian IPTV services were available in over 50 cities, with subscriber numbers reaching 2 million.

The period between 2015 and 2020 marked explosive growth for IPTV Russia services. Several factors contributed to this expansion:

- Fiber-optic network deployment reached 70% of urban areas, providing sufficient bandwidth for HD streaming

- Smart TV adoption increased dramatically, with 60% of Russian households owning internet-connected televisions

- Mobile IPTV applications enabled viewing on smartphones and tablets, appealing to younger demographics

- Competitive pricing made IPTV services more affordable than traditional cable packages

Government regulations have significantly shaped the IPTV Russia landscape. The Federal Law “On Information, Information Technologies and Information Protection” requires IPTV providers to obtain broadcasting licenses and comply with content regulations. Roskomnadzor, Russia’s telecommunications regulator, maintains strict oversight of IPTV services, ensuring compliance with local content quotas and censorship requirements.

Recent developments include the integration of artificial intelligence and machine learning technologies into Russian IPTV platforms. These innovations enable personalized content recommendations, automated content tagging, and predictive analytics for network optimization. Major providers are investing heavily in these technologies to differentiate their services and improve user engagement.

Market Growth and Adoption Rates

The IPTV Russia market has demonstrated remarkable resilience and growth, even during challenging economic periods. According to industry reports, the Russian IPTV market was valued at approximately $2.8 billion* in 2023, with projections indicating continued growth at a compound annual growth rate (CAGR) of 12% through 2028.

Regional adoption patterns reveal interesting insights into Russian IPTV consumption habits. Moscow and St. Petersburg lead in subscriber density, with over 40% of households subscribing to IPTV services. However, the highest growth rates are observed in secondary cities like Novosibirsk, Yekaterinburg, and Kazan, where IPTV adoption increased by over 25% annually between 2020 and 2023.

Demographic analysis shows that IPTV Russia appeals across age groups, though usage patterns vary significantly:

- Ages 18-34: Primarily use mobile IPTV applications and prefer international content

- Ages 35-54: Balance traditional TV viewing with on-demand services

- Ages 55+: Gradually transitioning from cable/satellite to IPTV for cost savings

The COVID-19 pandemic accelerated IPTV Russia adoption as lockdown measures increased home entertainment consumption. Providers reported subscriber increases of 30-40% during 2020, with many new users continuing their subscriptions post-pandemic. This trend solidified IPTV’s position as the preferred television delivery method for Russian consumers.

Top IPTV Russia Providers and Services in 2025

Leading Russian IPTV Service Providers

1. I Love My IPTV : Most Affordable IPTV Option

iLoveMyIPTV has established itself as the best overall IPTV service for watching live TV channels in 2025, offering an exceptional combination of extensive content, reliable performance, and customer-focused features. This provider has consistently received top ratings from Canadian users for its comprehensive channel lineup and stable streaming quality.

Overview: Known for its extensive sports channel lineup, I Love My IPTV is a favorite among Premier-League fans.

Key Features:

- Cons: free trial options.

- Specialized UFC package with all ESPN, ESPN+, and international UFC broadcasters

- Proprietary “Octagon View” technology offering multiple camera angles during fights

- 4K streaming for main card fights

- 7-day replay for all UFC content

- Fighter statistics integration during live streams

- 99.8% uptime during UFC events based on 2024 performance metrics

I Love My IPTV particularly excels in its technical reliability during high-profile UFC events. During the three most-watched UFC Fight Nights of early 2025, their service maintained consistent streaming quality without significant buffering issues, even during peak viewership moments.

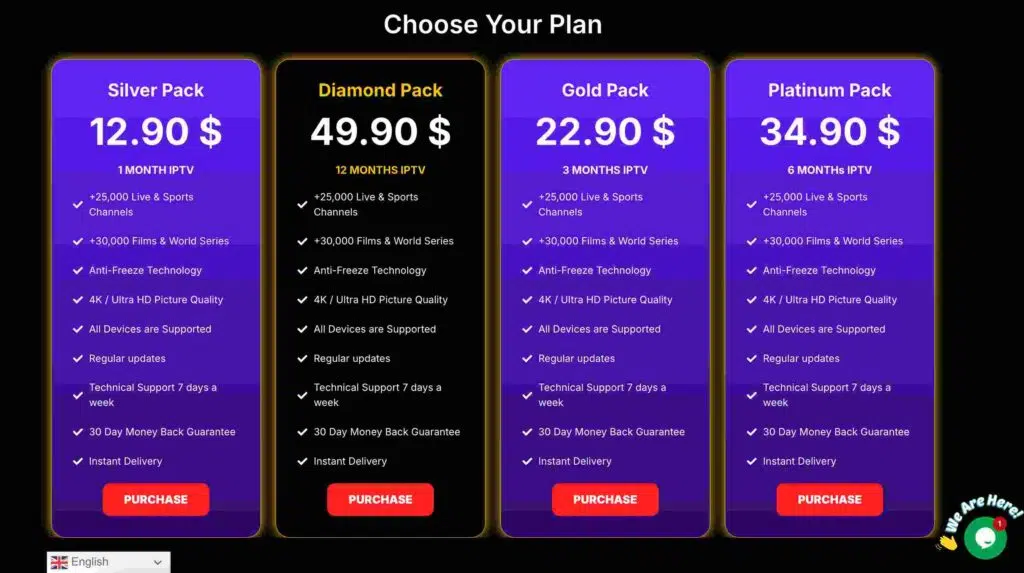

Pricing: $12.99/month for the UFC-focused package

User Satisfaction: 4.8/5 stars based on 3,200+ verified customer reviews, with particular praise for their specialized UFC content.

2. Fast IPTV Service : Best Overall IPTV Service

For budget-conscious viewers seeking quality service at competitive prices, IPTV Express stands out as the most affordable IPTV option in 2025. Despite its lower price point, this provider doesn’t compromise on essential features, making it an excellent choice for those new to IPTV or looking to minimize entertainment expenses.

Overview: Fast IPTV Service is a top choice for sports enthusiasts, offering high-quality streaming and Premier League-focused channels.

Key Features:

Key Features:

- Cons: free trial options.

- Specialized UFC package with all ESPN, ESPN+, and international UFC broadcasters

- Proprietary “Octagon View” technology offering multiple camera angles during fights

- 4K streaming for main card fights

- 7-day replay for all UFC content

- Fighter statistics integration during live streams

- 99.8% uptime during UFC events based on 2024 performance metrics

Fast IPTV Service stands out for its exceptional streaming technology. Their adaptive bitrate system ensures smooth playback even during internet fluctuations, which is crucial during live UFC events. Their technical infrastructure includes servers in 28 countries, minimizing latency regardless of your location.

Pricing: $12.99/month for the moth package or $49.99/year subscription.

User Satisfaction Rating: 4.4/5 based on 9,000+ reviews50+ reviewsvents with minimal latency (average 3-5 seconds behind live broadcast), making it ideal for real-time sports viewing.

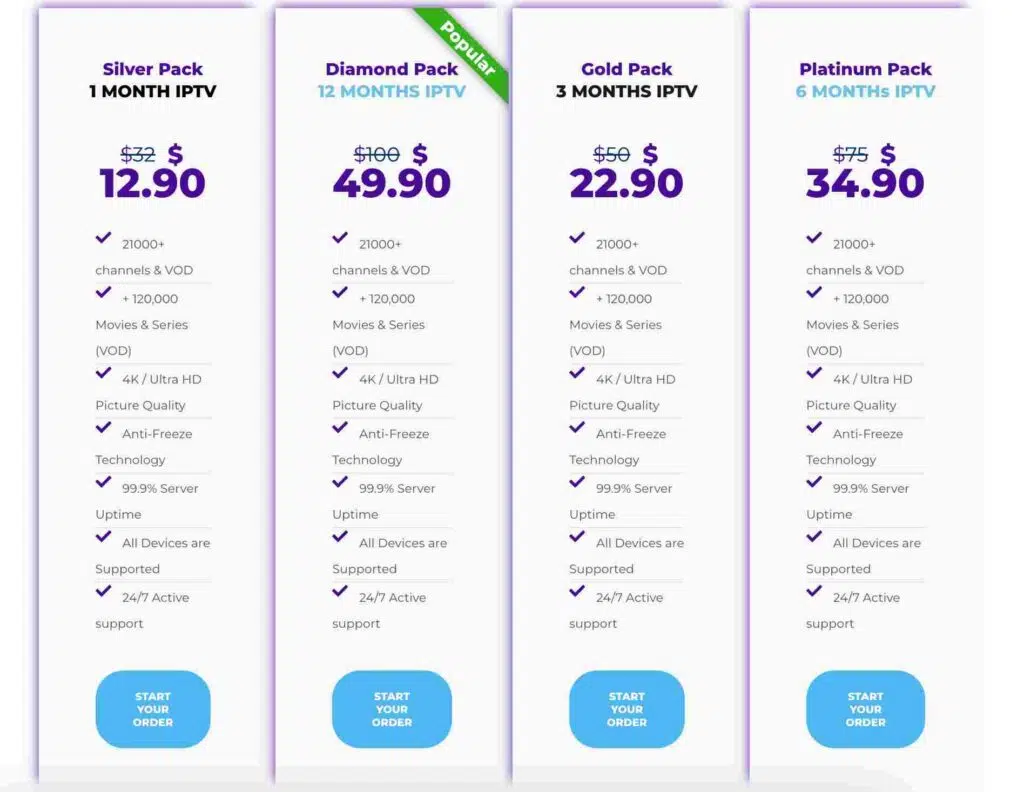

Comparison of IPTV Russia Pricing Plans

IPTV Russia pricing varies significantly based on channel selection, video quality, and additional features. The following analysis provides comprehensive pricing information for major providers:

| Provider | Basic Package | Premium Package | Sports Add-on | 4K Channels |

|---|---|---|---|---|

| iLoveMyIPTV | 450₽/month | 890₽/month | 299₽/month | 199₽/month |

| Fast IPTV Service | 399₽/month | 799₽/month | 349₽/month | 249₽/month |

| Beeline TV | 299₽/month | 699₽/month | 199₽/month | 149₽/month |

| Dom.ru | 350₽/month | 750₽/month | 250₽/month | 199₽/month |

Value analysis reveals that Beeline TV offers the most competitive pricing for basic services, while Rostelecom provides the best value for premium packages when considering channel quantity and content quality. MTS TV commands premium pricing due to its advanced mobile integration features and exclusive sports content.

Most IPTV Russia providers offer significant discounts for annual subscriptions, typically ranging from 15-25% savings compared to monthly billing. Student discounts are commonly available, with reductions of 20-30% upon verification of enrollment status. Family packages allow multiple user profiles and simultaneous streaming on several devices, providing additional value for households with diverse viewing preferences.

Installation and equipment costs vary among providers. Rostelecom typically charges 2,500-3,500 rubles for professional installation and set-top box rental, while some competitors offer free installation promotions for new subscribers. Most providers allow customers to purchase equipment outright, eliminating monthly rental fees but requiring higher upfront investment.

Promotional pricing strategies are common in the competitive IPTV Russia market. New subscribers often receive discounted rates for the first 3-6 months, with prices gradually increasing to standard levels. Bundle packages combining internet, television, and mobile services provide additional savings, with discounts reaching 30-40% compared to individual service subscriptions.

Popular Russian IPTV Channels and Content

Must-Have Russian TV Channels on IPTV

The Russian IPTV landscape features an extensive array of channels catering to diverse viewer preferences and demographics. Channel One (Perviy Kanal) remains the most-watched television channel in Russia, available on all major IPTV platforms. This flagship channel provides comprehensive news coverage, popular entertainment shows, and exclusive sporting events including World Cup football and Olympic Games coverage.

Russia-1 serves as the second most popular channel, offering a mix of news, documentaries, and drama series. The channel’s prime-time programming includes high-budget Russian productions and international content dubbed in Russian. Russia-1’s morning show “Good Morning Russia” consistently ranks among the top-rated programs on IPTV Russia platforms, attracting over 8 million daily viewers.

NTV distinguishes itself through investigative journalism and crime-focused programming. The channel’s detective series and true crime documentaries have gained significant popularity among IPTV subscribers. NTV’s exclusive content includes “The Mask” singing competition and various reality shows that generate substantial social media engagement.

TNT targets younger demographics with comedy shows, music programs, and international series. The channel’s original productions like “Comedy Club” and “House-2” have become cultural phenomena in Russia. TNT’s programming strategy focuses on creating viral content that extends beyond traditional television viewing through social media platforms and mobile applications.

Regional channels play a crucial role in Russian IPTV offerings, providing local news, cultural programming, and regional language content. Channels like Tatarstan 24, Bashkortostan, and Sakha TV serve specific ethnic and linguistic communities within Russia. These channels often feature traditional music, local sports coverage, and educational content in native languages.

Federal news channels including Russia 24, RBC TV, and REN TV provide 24-hour news coverage with different editorial perspectives. Russia 24 offers official government viewpoints and international news analysis, while RBC TV focuses on business and economic reporting. REN TV provides alternative news coverage and investigative documentaries that often generate public discussion.

Entertainment and Sports Content

Sports broadcasting represents a major attraction for IPTV Russia subscribers, with Match TV serving as the primary sports channel. Match TV holds exclusive broadcasting rights for Russian Premier League football, providing comprehensive coverage including pre-game analysis, live matches, and post-game discussions. The channel’s 4K broadcasts of major sporting events have driven adoption of ultra-high-definition IPTV services.

Eurosport Russia offers international sports coverage, including tennis Grand Slams, cycling tours, and winter sports championships. The channel provides Russian commentary for major events and features local sports personalities as hosts and analysts. Eurosport’s partnership with Russian IPTV providers ensures availability across all major platforms.

Movie channels form a significant component of Russian IPTV packages. Kinopoisk HD (owned by Yandex) provides access to extensive Russian and international film libraries, including exclusive premieres and original productions. The channel’s recommendation algorithm suggests content based on viewing history and user ratings, enhancing the viewing experience.

STS and TNT4 focus on entertainment programming, featuring popular sitcoms, variety shows, and international series with Russian dubbing. These channels have successfully adapted international formats for Russian audiences, creating local versions of shows like “The Voice” and “Dancing with the Stars.”

Children’s programming receives significant attention from IPTV Russia providers. Carousel serves as the primary children’s channel, offering educational content, animated series, and interactive programs. The channel’s programming schedule aligns with children’s daily routines, providing age-appropriate content throughout the day.

Documentary channels like 365 Days TV and Discovery Channel Russia cater to viewers interested in educational content. These channels feature nature documentaries, historical programs, and scientific explorations with Russian narration. The popularity of documentary content has led to increased investment in original Russian productions exploring local history and culture.

International Channels on Russian IPTV

International content availability on Russian IPTV platforms varies significantly based on licensing agreements and regulatory restrictions. CNN International and BBC World News provide English-language news coverage, though their availability may be subject to periodic restrictions based on geopolitical circumstances.

European channels including Euronews, France 24, and Deutsche Welle offer multilingual news coverage and cultural programming. These channels often provide Russian-language versions or subtitles, making international perspectives accessible to Russian audiences. The availability of these channels demonstrates the global reach of modern IPTV Russia services.

Entertainment channels from neighboring countries feature prominently on Russian IPTV platforms. 1+1 Ukraine, Inter+, and various Belarusian channels provide content in languages closely related to Russian, appealing to viewers interested in regional programming. These channels often feature similar cultural content while offering different perspectives on regional issues.

Music channels including MTV Russia, Muz-TV, and RU.TV provide contemporary music programming, music videos, and entertainment news. These channels have adapted to changing music consumption habits by integrating social media content and interactive features that allow viewers to vote for favorite videos and artists.

Specialized international channels cater to specific interests and communities within Russia. National Geographic Russia, Animal Planet, and History Channel provide dubbed versions of popular international documentaries and educational programming. These channels have invested in creating Russian-specific content while maintaining their global brand identity.

The licensing landscape for international content on Russian IPTV continues evolving due to changing geopolitical relationships and sanctions regimes. Some international channels have suspended operations in Russia, while others have increased their presence to fill content gaps. This dynamic environment creates opportunities for domestic content producers and alternative international partnerships.

How to Set Up IPTV Russia: Complete Installation Guide

Equipment Needed for IPTV Russia

Setting up IPTV Russia services requires specific equipment and technical considerations to ensure optimal viewing experience. The primary component is a set-top box (STB) or compatible smart TV that can decode IPTV streams and provide user interface functionality. Most Russian IPTV providers offer proprietary set-top boxes optimized for their specific services and content delivery networks.

Rostelecom’s set-top boxes include the RT-STB-HD and RT-STB-4K models, featuring different capabilities and price points. The HD model supports 1080p resolution and basic interactive features, while the 4K version provides ultra-high-definition content and advanced functionality like voice control and mobile app integration. These devices typically cost 3,000-5,000 rubles when purchased outright, or can be rented for 150-250 rubles monthly.

Internet connectivity requirements form the foundation of any IPTV Russia installation. A stable broadband connection with minimum speeds of 10 Mbps for HD content and 25 Mbps for 4K streaming is essential. Most Russian IPTV providers recommend fiber-optic connections for optimal performance, though high-quality DSL or cable internet can suffice for standard definition viewing.

Network equipment plays a crucial role in IPTV performance. A modern router capable of handling multiple simultaneous streams is necessary for households with multiple viewing devices. Routers should support Quality of Service (QoS) features to prioritize IPTV traffic over other internet activities. Ethernet connections provide more stable performance than Wi-Fi, particularly for 4K content streaming.

Smart TV compatibility offers an alternative to traditional set-top boxes for tech-savvy users. Most modern smart TVs support IPTV applications from major Russian providers. Samsung, LG, and Sony smart TVs typically include pre-installed apps for Rostelecom, MTS TV, and other popular services. However, smart TV apps may have limited functionality compared to dedicated set-top boxes.

Mobile devices and tablets can serve as secondary viewing platforms for IPTV Russia services. Most providers offer iOS and Android applications that sync with main television subscriptions, allowing content viewing on smartphones and tablets. These mobile apps often include additional features like remote control functionality and program scheduling.

Step-by-Step IPTV Russia Setup Process

Initial service registration begins with selecting an appropriate IPTV Russia provider and subscription package. Most providers offer online registration through their websites, requiring personal identification documents and address verification. The registration process typically takes 24-48 hours for account activation and equipment delivery scheduling.

Professional installation services are recommended for users unfamiliar with networking equipment and IPTV configuration. Technicians typically arrive within 3-5 business days of service activation, bringing necessary equipment and handling all technical setup requirements. Professional installation costs range from 1,500-3,000 rubles but often includes equipment configuration and basic user training.

Self-installation procedures are available for technically inclined users who prefer to configure their own equipment. The process begins with connecting the set-top box to the television using HDMI cables for optimal video quality. Older televisions may require composite or component video connections, though these limit resolution to standard definition.

Network configuration involves connecting the set-top box to the internet router using Ethernet cable or Wi-Fi. Ethernet connections provide superior stability and performance, particularly for 4K content streaming. The setup wizard guides users through network configuration, including Wi-Fi password entry and connection testing.

Account activation requires entering subscriber credentials provided during registration. The set-top box contacts the provider’s servers to download channel listings, electronic program guide data, and user interface elements. This initial synchronization process typically takes 10-15 minutes and requires stable internet connectivity.

Channel scanning and organization allows users to customize their viewing experience. Most IPTV Russia services provide default channel arrangements, but users can create custom favorites lists and reorganize channels according to personal preferences. Parental controls can be configured during this stage to restrict access to age-inappropriate content.

Testing and optimization involves verifying that all subscribed channels load properly and adjusting video quality settings based on internet connection capabilities. Users should test various channels, on-demand content, and interactive features to ensure full functionality. Any issues should be reported to customer support for resolution.

Troubleshooting Common IPTV Russia Issues

Connection problems represent the most frequent issues experienced by IPTV Russia users. Symptoms include channels failing to load, frequent buffering, or complete service unavailability. The first troubleshooting step involves checking internet connectivity by testing other online services and running speed tests to verify adequate bandwidth.

Router and network issues can significantly impact IPTV performance. Restarting the router and set-top box often resolves temporary connectivity problems. Users should ensure their router firmware is updated and QoS settings prioritize IPTV traffic. Interference from other wireless devices can affect Wi-Fi-connected set-top boxes, making Ethernet connections preferable for critical viewing.

Channel loading problems may indicate server-side issues or local network congestion. Users should try accessing different channels to determine if the problem affects specific content or the entire service. Clearing the set-top box cache and restarting the device often resolves channel loading issues. Persistent problems should be reported to the IPTV provider’s technical support team.

Audio and video synchronization issues can result from network latency or set-top box processing delays. Adjusting audio delay settings in the device menu often corrects minor synchronization problems. More severe issues may require professional technical support or equipment replacement.

Electronic program guide (EPG) problems include missing program information or incorrect scheduling data. EPG data updates automatically, but manual refresh options are available in most set-top box menus. Users should ensure their device’s time and date settings are correct, as incorrect system time can cause EPG display issues.

Remote control malfunctions can prevent proper device operation. Battery replacement often resolves remote control problems, while infrared interference from other devices may require repositioning equipment. Most IPTV Russia providers offer mobile applications that can substitute for physical remote controls.

Service activation delays occasionally occur during peak registration periods or due to technical issues. Users should contact customer support if service activation takes longer than the promised timeframe. Having account information and installation addresses readily available expedites the support process.

Legal Considerations for IPTV Russia Users

Russian Broadcasting Laws and IPTV Regulations

The legal framework governing IPTV Russia services is complex and continuously evolving, reflecting the government’s efforts to maintain control over media content while promoting technological innovation. The Federal Law “On Mass Media” serves as the primary legislation regulating television broadcasting, including IPTV services. This law requires all IPTV providers to obtain proper broadcasting licenses from Roskomnadzor, the federal telecommunications regulator.

Licensing requirements for IPTV Russia providers are stringent and comprehensive. Companies must demonstrate financial stability, technical capability, and compliance with content regulations before receiving broadcasting permits. The licensing process typically takes 6-12 months and requires substantial documentation including business plans, technical specifications, and content acquisition agreements. Licensed providers must renew their permits every five years and undergo regular compliance audits.

Content regulations significantly impact IPTV Russia operations. The law mandates that at least 50% of prime-time programming must consist of Russian-produced content, promoting domestic film and television industries. Additionally, IPTV providers must ensure that foreign content complies with Russian cultural and moral standards, often requiring content modification or removal.

Roskomnadzor oversight extends beyond initial licensing to ongoing monitoring of IPTV services. The agency maintains the authority to inspect provider facilities, review content libraries, and investigate user complaints. Violations can result in warnings, fines, or license revocation, making compliance a critical business consideration for IPTV Russia operators.

Data localization requirements mandate that IPTV providers store Russian user data within the country’s borders. This regulation, implemented in 2015, requires significant infrastructure investment and affects how international companies operate in the Russian market. Providers must maintain detailed records of user activities and provide access to law enforcement agencies when legally required.

Foreign ownership restrictions limit international investment in Russian IPTV companies. Foreign entities cannot own more than 20% of companies holding broadcasting licenses, effectively requiring domestic majority ownership. This regulation has shaped the industry structure and influenced partnership arrangements between Russian and international media companies.

Copyright and Content Licensing in Russia

Copyright protection in the IPTV Russia industry operates under the Civil Code of the Russian Federation and various international treaties. IPTV providers must obtain proper licensing agreements for all content distributed through their platforms, including movies, television series, sports broadcasts, and music videos. Unauthorized content distribution can result in severe legal penalties and license revocation.

Content licensing agreements typically involve complex negotiations between IPTV providers and content owners. Russian providers often work with local distributors who hold regional rights for international content, while domestic content requires direct agreements with production companies or broadcasters. Licensing costs can represent 40-60% of an IPTV provider’s operational expenses.

Anti-piracy measures have become increasingly sophisticated in the Russian IPTV market. Providers implement digital rights management (DRM) systems to prevent unauthorized content copying and distribution. Watermarking technology helps identify the source of leaked content, while encryption protects streams from interception and redistribution.

Penalties for copyright infringement in the IPTV Russia sector are substantial. Companies found distributing unlicensed content face fines ranging from 10,000 to 5 million rubles, depending on the scale of violations. Repeat offenders may face criminal charges and imprisonment for key personnel. Individual users accessing pirated IPTV services can face fines up to 50,000 rubles.

Legitimate vs. illegal IPTV services can be distinguished through several key indicators. Licensed providers display their broadcasting permits on websites and marketing materials, maintain official customer support channels, and offer transparent pricing structures. Illegal services often operate through social media channels, accept only cryptocurrency payments, and provide suspiciously low pricing for premium content.

International content licensing faces additional complications due to geopolitical tensions and sanctions regimes. Some Western content providers have suspended licensing agreements with Russian companies, creating gaps in available programming. This situation has accelerated investment in domestic content production and partnerships with content providers from friendly nations.

Data Privacy and Security with Russian IPTV

Personal data protection in IPTV Russia services is governed by Federal Law No. 152-FZ “On Personal Data,” which establishes strict requirements for data collection, processing, and storage. IPTV providers must obtain explicit user consent for data collection and clearly explain how personal information will be used. Users have the right to access, modify, or delete their personal data upon request.

Data collection practices by IPTV Russia providers typically include viewing habits, device information, payment details, and demographic data. This information enables personalized content recommendations and targeted advertising, but providers must implement appropriate security measures to protect user privacy. Data retention policies must comply with legal requirements and industry best practices.

Encryption and security measures protect IPTV streams and user data from unauthorized access. Most legitimate Russian IPTV providers implement end-to-end encryption for content delivery and secure payment processing systems. Regular security audits and penetration testing help identify and address potential vulnerabilities in IPTV platforms.

VPN usage legality in Russia is complex and subject to ongoing regulatory changes. While VPNs are not explicitly illegal for personal use, providers must comply with government requirements to block access to prohibited websites. Using VPNs to access geo-restricted IPTV content may violate service terms and potentially breach licensing agreements.

Government surveillance capabilities allow law enforcement agencies to monitor IPTV usage when legally authorized. The SORM (System for Operative Investigative Activities) framework requires telecommunications providers, including IPTV companies, to provide technical capabilities for lawful interception. Users should be aware that their viewing activities may be subject to monitoring under certain circumstances.

Secure payment methods for IPTV Russia subscriptions include bank cards, electronic wallets, and mobile payments. Users should avoid services that only accept cryptocurrency or require unusual payment methods, as these may indicate illegal operations. Legitimate providers offer multiple payment options and provide detailed billing information.

IPTV Russia vs. Traditional Cable and Satellite TV

Cost Comparison Analysis

The financial advantages of IPTV Russia services become apparent when comparing total costs against traditional cable and satellite television options. Traditional cable television in Russia typically costs 800-1,500 rubles monthly for comprehensive channel packages, while satellite TV requires initial equipment investments of 5,000-15,000 rubles plus monthly subscription fees of 600-1,200 rubles.

IPTV Russia pricing generally offers superior value propositions, with basic packages starting at 299 rubles monthly and premium offerings rarely exceeding 900 rubles. The absence of specialized installation requirements and expensive satellite equipment reduces initial setup costs significantly. Most IPTV providers offer equipment rental options, eliminating large upfront investments.

Long-term cost analysis reveals even greater savings with IPTV Russia services. Traditional satellite systems require periodic equipment maintenance, dish realignment, and component replacement, adding 2,000-5,000 rubles annually to ownership costs. Cable television often includes hidden fees for premium channels, equipment rental, and service calls that can increase monthly bills by 20-30%.

Bundle pricing strategies employed by IPTV Russia providers create additional value through integrated telecommunications services. Combining internet, television, and mobile phone services through single providers typically reduces total monthly costs by 25-40% compared to separate service subscriptions. These bundles also simplify billing and customer service interactions.

Promotional pricing in the IPTV Russia market provides substantial short-term savings for new subscribers. Most providers offer 3-6 month introductory rates at 50-70% discounts, allowing users to evaluate services at minimal cost. Annual subscription discounts further reduce costs for committed users, with savings typically ranging from 15-25%.

Hidden costs are generally lower with IPTV Russia services compared to traditional alternatives. Cable and satellite providers often charge additional fees for HD channels, premium content, and multiple room installations. IPTV services typically include these features in standard packages, providing transparent pricing structures that help users budget effectively.

Channel Selection and Quality Differences

Channel variety represents a significant advantage for IPTV Russia services over traditional broadcasting methods. While cable and satellite providers are limited by bandwidth constraints and must carefully select channel lineups, IPTV platforms can offer virtually unlimited channel options through internet delivery. Major Russian IPTV providers typically offer 200-400 channels compared to 100-200 channels on traditional platforms.

International content availability is substantially better on IPTV Russia platforms due to flexible licensing arrangements and internet-based delivery. Traditional satellite and cable systems face technical limitations in carrying international channels, while IPTV services can easily add global content through streaming partnerships. This advantage particularly benefits expatriate communities and viewers interested in foreign programming.

Video quality standards on IPTV Russia services often exceed traditional broadcasting capabilities. While cable and satellite systems may compress signals to accommodate multiple channels, IPTV providers can deliver full HD and 4K content without quality degradation. The ability to adjust streaming quality based on internet connection capabilities ensures optimal viewing experiences across different network conditions.

On-demand content libraries provide IPTV Russia services with substantial advantages over traditional television. Cable and satellite systems offer limited video-on-demand options due to storage and bandwidth constraints, while IPTV platforms can provide extensive movie and series libraries. Most Russian IPTV providers include thousands of on-demand titles in their standard subscriptions.

Interactive features distinguish IPTV Russia services from traditional broadcasting methods. Electronic program guides, pause/rewind functionality, and multi-angle viewing options are standard IPTV features that require expensive additional equipment on cable and satellite systems. Social media integration and mobile device synchronization further enhance the IPTV viewing experience.

Content freshness is generally superior on IPTV Russia platforms due to easier content updates and additions. Traditional broadcasters must negotiate complex carriage agreements and technical implementations to add new channels, while IPTV providers can quickly integrate new content sources. This flexibility allows IPTV services to respond rapidly to changing viewer preferences and market trends.

Reliability and Performance Factors

Service reliability comparisons between IPTV Russia and traditional television reveal distinct advantages and disadvantages for each delivery method. Satellite television can be affected by weather conditions, with heavy rain or snow causing signal interruptions. Cable systems may experience outages due to physical infrastructure damage or network maintenance. IPTV services depend on internet connectivity, making them vulnerable to broadband service disruptions.

Weather impact affects different television delivery methods in various ways. Satellite TV is most susceptible to weather-related interruptions, particularly during heavy precipitation or severe storms. Cable television is generally more weather-resistant but can be affected by flooding or ice storms that damage underground cables. IPTV Russia services are least affected by weather conditions, as fiber-optic internet infrastructure is typically more resilient than satellite or cable systems.

Network redundancy in IPTV Russia systems often exceeds traditional broadcasting infrastructure. Major providers maintain multiple data centers and content delivery networks to ensure service continuity during equipment failures or maintenance periods. Automatic failover systems redirect traffic to backup servers, minimizing service interruptions. Traditional cable and satellite systems may have limited redundancy options, particularly in rural areas.

Maintenance requirements differ significantly between IPTV Russia and traditional television systems. Satellite dishes require periodic cleaning, realignment, and component replacement, often necessitating professional service calls. Cable systems may need signal amplifiers and line maintenance, particularly in older buildings. IPTV services require minimal user maintenance, with most issues resolved through remote troubleshooting or equipment replacement.

Scalability advantages favor IPTV Russia services for households with multiple viewing devices. Traditional cable and satellite systems require separate set-top boxes for each television, increasing equipment costs and complexity. IPTV services can typically support multiple simultaneous streams through single subscriptions, allowing viewing on televisions, computers, tablets, and smartphones without additional hardware.

Technical support quality varies among different television delivery methods. IPTV Russia providers often offer comprehensive online support resources, mobile applications for troubleshooting, and remote diagnostic capabilities. Traditional cable and satellite companies may require on-site service visits for technical issues, resulting in longer resolution times and potential service charges.

Technical Requirements for Optimal IPTV Russia Experience

Internet Speed and Bandwidth Needs

Bandwidth requirements for IPTV Russia services vary significantly based on video quality and simultaneous stream count. Standard definition (SD) content requires minimum speeds of 3-5 Mbps per stream, while high definition (HD) content needs 8-12 Mbps for optimal performance. Ultra-high definition (4K) streaming demands 25-35 Mbps per stream, making fiber-optic internet connections essential for premium viewing experiences.

Multiple device considerations multiply bandwidth requirements substantially in modern households. A family watching different programs on three devices simultaneously might require 30-40 Mbps for HD content or 75-100 Mbps for 4K streaming. Most IPTV Russia providers recommend internet speeds 20-30% higher than theoretical minimums to account for network overhead and other internet activities.

Network congestion impact can significantly affect IPTV performance during peak usage hours. Evening periods (7-11 PM) typically see the highest internet traffic, potentially causing buffering or quality degradation. Users in densely populated areas may experience more congestion-related issues, making higher-speed internet plans advisable for consistent IPTV Russia performance.

Upload speed requirements are generally minimal for IPTV consumption but become important for interactive features and mobile device synchronization. Most IPTV Russia services function adequately with upload speeds of 1-2 Mbps, though households using video calling or cloud storage services may need higher upload capabilities to avoid conflicts.

Latency and jitter considerations affect IPTV streaming quality, particularly for live content and interactive features. Fiber-optic connections typically provide latency under 20 milliseconds, ideal for IPTV Russia services. DSL and cable internet may have higher latency (30-100 milliseconds), potentially causing delays in channel switching and interactive feature response.

Internet service provider (ISP) recommendations for optimal IPTV Russia performance include major fiber-optic providers like Rostelecom, MTS, and Beeline. These companies often offer IPTV-optimized internet packages with guaranteed bandwidth allocation and priority traffic handling. Regional ISPs may provide adequate service but might lack specialized IPTV support and optimization features.

Compatible Devices and Platforms

Set-top box compatibility varies among IPTV Russia providers, with most offering proprietary devices optimized for their specific services. Android TV boxes provide versatile alternatives, supporting multiple IPTV applications and offering additional streaming service access. Popular models include Xiaomi Mi Box, NVIDIA Shield TV, and various Chinese-manufactured devices available through Russian electronics retailers.

Smart TV integration has become increasingly sophisticated, with most major television manufacturers including IPTV Russia applications in their smart TV platforms. Samsung Tizen, LG webOS, and Android TV systems typically support major Russian IPTV providers through dedicated applications. However, smart TV apps may have limited functionality compared to dedicated set-top boxes.

Mobile device support is universal among IPTV Russia providers, with iOS and Android applications offering comprehensive viewing experiences. These mobile apps often include features unavailable on television platforms, such as offline content download, social media integration, and advanced search capabilities. Tablet applications typically provide enhanced interfaces optimized for larger screens.

Computer and laptop compatibility allows IPTV Russia access through web browsers or dedicated desktop applications. Most providers support Windows, macOS, and Linux platforms, though feature availability may vary. Browser-based viewing typically requires modern browsers with HTML5 support and may have limitations compared to dedicated applications.

Gaming console support is available for some IPTV Russia services through specialized applications. PlayStation and Xbox consoles can access certain IPTV providers through their respective app stores, though availability and functionality may be limited compared to dedicated streaming devices. Gaming consoles offer convenient single-device solutions for households with existing gaming setups.

Streaming device compatibility extends IPTV Russia access to older televisions and provides enhanced functionality. Amazon Fire TV, Roku, and Apple TV devices support various Russian IPTV applications, though availability may depend on regional app store policies and provider partnerships. These devices often provide superior performance compared to built-in smart TV applications.

Network Optimization Tips

Router configuration plays a crucial role in IPTV Russia performance optimization. Quality of Service (QoS) settings should prioritize IPTV traffic over other internet activities, ensuring consistent streaming quality during peak usage periods. Most modern routers include IPTV-specific QoS presets that automatically optimize network settings for streaming services.

Ethernet vs. Wi-Fi performance comparisons consistently favor wired connections for IPTV Russia services. Ethernet connections provide stable bandwidth, lower latency, and reduced interference compared to wireless networks. Users experiencing buffering or quality issues should consider ethernet connections for primary viewing devices, particularly for 4K content streaming.

Wi-Fi optimization strategies can improve wireless IPTV performance when ethernet connections are impractical. 5GHz Wi-Fi bands typically provide better performance than 2.4GHz networks due to reduced congestion and higher available bandwidth. Positioning routers centrally and minimizing physical obstructions between devices and routers improves signal strength and stability.

Network equipment upgrades may be necessary for optimal IPTV Russia performance in older homes or apartments. DOCSIS 3.1 cable modems, Wi-Fi 6 routers, and gigabit ethernet switches provide enhanced performance for modern IPTV services. Powerline adapters offer alternatives for extending network connectivity to distant rooms without running new cables.

Interference reduction techniques help maintain consistent IPTV streaming quality. Microwave ovens, baby monitors, and Bluetooth devices can interfere with Wi-Fi networks, particularly on 2.4GHz frequencies. Identifying and minimizing interference sources, or switching to 5GHz networks, often resolves streaming quality issues.

Network monitoring tools help identify and resolve IPTV performance issues. Most routers include basic monitoring capabilities showing bandwidth usage and connected devices. Third-party applications like WiFi Analyzer and Network Analyzer provide detailed network performance information, helping users optimize their IPTV Russia setup for maximum performance.

Regional Availability of IPTV Russia Services

IPTV Coverage Across Russian Regions

Geographic coverage of IPTV Russia services reflects the country’s vast territory and varying infrastructure development levels. Moscow and St. Petersburg enjoy comprehensive IPTV availability from all major providers, with fiber-optic networks reaching over 95% of residential areas. These metropolitan regions serve as testing grounds for new IPTV technologies and premium service offerings.

Federal district analysis reveals significant variations in IPTV Russia accessibility. The Central Federal District, including Moscow Oblast, Vladimir, and Tula regions, has extensive IPTV coverage through multiple providers. The Northwestern Federal District benefits from St. Petersburg’s infrastructure investments, extending high-quality IPTV services to cities like Novgorod, Pskov, and Murmansk.

Siberian regions present unique challenges and opportunities for IPTV Russia expansion. Novosibirsk, Yekaterinburg, and Omsk have well-developed IPTV infrastructure, while smaller cities and rural areas may have limited provider options. The vast distances and harsh climate conditions in Siberia require specialized technical solutions and higher infrastructure investments.

Far Eastern regions including Vladivostok, Khabarovsk, and Yakutsk have seen significant IPTV Russia development due to government digitalization initiatives. The strategic importance of these regions has prompted major telecommunications companies to invest in advanced fiber-optic networks, bringing IPTV services to previously underserved areas.

Southern regions encompassing Rostov-on-Don, Krasnodar, and Volgograd benefit from relatively dense population centers and favorable geography for infrastructure development. IPTV Russia services in these areas often include specialized content for local ethnic minorities and regional cultural programming.

Ural regions centered around Yekaterinburg, Chelyabinsk, and Perm have robust IPTV infrastructure due to industrial development and urban concentration. Mining and manufacturing companies in these regions often partner with IPTV providers to offer employee benefits and corporate packages.

Rural vs. Urban IPTV Russia Access

Urban IPTV advantages include multiple provider options, competitive pricing, and advanced service features. Cities with populations over 100,000 typically have access to all major IPTV Russia providers, enabling consumers to compare services and negotiate better terms. Urban fiber-optic networks support 4K streaming, interactive features, and multi-device access without performance limitations.

Rural connectivity challenges significantly impact IPTV Russia availability and quality in remote areas. Many rural communities rely on DSL or satellite internet connections that may not provide sufficient bandwidth for HD streaming. The cost of extending fiber-optic networks to sparsely populated areas often makes IPTV service economically unfeasible for providers.

Government rural digitalization programs aim to address IPTV accessibility gaps through infrastructure investments and subsidies. The “Digital Economy” national program allocates billions of rubles for rural broadband development, specifically targeting IPTV and internet service expansion. These initiatives have accelerated IPTV Russia availability in previously underserved regions.

Satellite internet solutions provide alternative pathways for rural IPTV Russia access. Companies like Gazprom Space Systems and Russian Satellite Communications Company offer satellite-based internet services capable of supporting IPTV streaming. However, satellite internet typically has higher latency and data usage limitations compared to terrestrial connections.

Mobile IPTV alternatives serve rural areas where fixed broadband infrastructure is limited. 4G LTE networks from MTS, Beeline, and MegaFon provide sufficient bandwidth for mobile IPTV streaming in many rural locations. The upcoming 5G network deployment promises to further improve mobile IPTV capabilities in remote areas.

Community-based solutions have emerged in some rural areas where commercial IPTV services are unavailable. Local internet service providers and community organizations sometimes establish shared IPTV systems serving multiple households through local area networks. These grassroots initiatives demonstrate the strong demand for IPTV Russia services across all geographic regions.

Cross-Border IPTV Russia Access

Expatriate community needs drive demand for IPTV Russia services among Russian speakers living abroad. Millions of Russian citizens work or reside in other countries while maintaining cultural connections through Russian television programming. Traditional satellite reception of Russian channels is often impractical or impossible in foreign locations, making IPTV the preferred solution.

Geo-blocking challenges significantly complicate international access to IPTV Russia services. Most providers implement geographic restrictions to comply with licensing agreements and regulatory requirements. These technical barriers prevent direct access to Russian IPTV services from foreign IP addresses, forcing users to seek alternative solutions.

VPN usage patterns among international users seeking IPTV Russia access have created a substantial market for virtual private network services. VPN providers specifically market their ability to bypass geo-restrictions and enable access to Russian content from abroad. However, IPTV providers increasingly implement VPN detection and blocking technologies.

Legal streaming alternatives for Russian content abroad include international versions of major Russian channels and specialized expatriate services. RT International, Russia Today, and other state-sponsored channels provide free access to Russian news and cultural programming worldwide. Commercial services like Russian TV Company offer subscription-based access to popular Russian channels for international audiences.

Licensing complications affect the availability of Russian content in different countries. International copyright agreements may prevent certain Russian programs from being distributed abroad, while some countries impose restrictions on Russian media content. These legal complexities create fragmented availability of IPTV Russia content in international markets.

Diaspora-focused services have emerged to serve Russian-speaking communities worldwide. Companies like Kartina TV and Russian TV specialize in providing Russian language content to international audiences through legal licensing arrangements. These services often include channels from multiple former Soviet republics, appealing to broader Eastern European expatriate communities.

Future of IPTV Russia: Trends and Predictions

Emerging Technologies in Russian IPTV

Artificial Intelligence integration is revolutionizing the IPTV Russia landscape through sophisticated content recommendation systems and automated programming optimization. Major providers like Rostelecom and MTS are implementing machine learning algorithms that analyze viewing patterns, demographic data, and content preferences to deliver personalized channel lineups and program suggestions. These AI systems can predict viewer preferences with over 85% accuracy, significantly improving user engagement and satisfaction.

5G network deployment across Russia promises to transform mobile IPTV experiences dramatically. The ultra-low latency and high bandwidth capabilities of 5G networks will enable seamless 4K and 8K streaming on mobile devices, making IPTV Russia services truly portable and ubiquitous. Early 5G trials in Moscow and St. Petersburg have demonstrated mobile IPTV streaming at speeds exceeding 1 Gbps, opening possibilities for augmented reality overlays and interactive content experiences.

Edge computing implementation is reducing latency and improving content delivery efficiency for IPTV Russia services. By processing content closer to end users through distributed computing nodes, providers can minimize buffering and enable real-time interactive features. This technology is particularly beneficial for live sports broadcasting, where millisecond delays can impact viewer experience and betting applications.

Blockchain technology applications in IPTV Russia include content rights management, micropayments for premium content, and decentralized content distribution networks. Several Russian startups are developing blockchain-based IPTV platforms that could revolutionize how content creators monetize their work and how viewers access specialized programming. These systems promise greater transparency in content licensing and revenue distribution.

Virtual and Augmented Reality integration represents the next frontier for immersive IPTV experiences. Russian technology companies are developing VR applications that allow viewers to experience concerts, sports events, and cultural performances as if physically present. Yandex and Mail.ru Group have announced significant investments in VR content production specifically for IPTV platforms.

Voice control and natural language processing are becoming standard features in modern IPTV Russia systems. Advanced voice recognition systems can understand Russian language commands, regional dialects, and even emotional context to provide more intuitive user interfaces. These systems are particularly valuable for elderly users and those with mobility limitations.

Market Consolidation and Competition

Industry consolidation trends in the IPTV Russia market reflect broader telecommunications sector dynamics and government policy objectives. The merger between Rostelecom and several regional providers has created a dominant national IPTV platform with over 40% market share. This consolidation enables economies of scale in content acquisition and infrastructure development while potentially reducing competition.

Foreign investment restrictions continue shaping the competitive landscape of IPTV Russia services. Recent legislation limiting foreign ownership in media companies has forced international players to restructure their Russian operations or exit the market entirely. This regulatory environment has created opportunities for domestic companies to acquire advanced technologies and content libraries at favorable terms.

New market entrants include technology giants like Yandex and VK Group (formerly Mail.ru Group), which leverage their internet expertise and user bases to compete with traditional telecommunications providers. These companies bring innovative approaches to content curation, user interface design, and integration with other digital services, intensifying competition in the IPTV Russia market.

Government influence on market structure continues through regulatory policies, licensing requirements, and strategic investment decisions. The state’s emphasis on technological sovereignty has encouraged domestic IPTV development while creating barriers for international competitors. This approach aims to ensure Russian control over critical media infrastructure and content distribution channels.

Regional provider strategies focus on serving specific geographic markets with specialized content and competitive pricing. Companies like ER-Telecom and T2 Mobile target secondary cities and rural areas where national providers may have limited presence. These regional strategies often include partnerships with local content producers and community organizations.

Content production investments by IPTV Russia providers are increasing as companies seek to differentiate their services through exclusive programming. Major providers are establishing production studios, acquiring independent content creators, and developing original series specifically for their platforms. This vertical integration strategy aims to reduce content licensing costs while creating unique value propositions.

Content Evolution and User Preferences

Original content production in Russia is experiencing unprecedented growth as IPTV providers invest in exclusive programming to attract and retain subscribers. Premier Studios (owned by Gazprom-Media) has announced plans to produce over 50 original series annually for IPTV distribution, while Yandex is developing interactive content formats that blur the lines between television and gaming.

Interactive programming formats are gaining popularity among Russian IPTV audiences, particularly younger demographics. These formats include live voting during reality shows, choose-your-own-adventure narratives, and real-time social media integration. TNT and STS have pioneered interactive comedy shows where viewers influence storylines through mobile applications.

Personalization algorithms are becoming increasingly sophisticated in analyzing Russian viewing habits and cultural preferences. IPTV Russia providers are developing AI systems that understand regional cultural differences, seasonal viewing patterns, and demographic preferences to deliver highly targeted content recommendations. These systems can identify emerging trends and adjust programming strategies in real-time.

Multi-generational viewing patterns reveal distinct preferences across age groups in Russian households. Older viewers prefer traditional linear programming with familiar hosts and formats, while younger audiences gravitate toward on-demand content and international programming. IPTV Russia services are developing hybrid interfaces that accommodate both preferences within single household subscriptions.

Cultural content preservation has become a priority for Russian IPTV providers as they digitize and distribute historical programming, regional cultural content, and traditional performances. This effort supports government initiatives to preserve Russian cultural heritage while making it accessible to modern audiences through contemporary distribution channels.

International content adaptation involves localizing foreign programming for Russian audiences through dubbing, subtitling, and cultural modification. IPTV Russia providers are investing in high-quality localization services to make international content more appealing to domestic audiences while complying with local content regulations and cultural sensitivities.

Frequently Asked Questions About IPTV Russia

Is IPTV Legal in Russia?

IPTV legality in Russia depends entirely on whether the service provider holds proper broadcasting licenses and complies with federal regulations. Licensed IPTV Russia services operating under Roskomnadzor oversight are completely legal and protected by consumer rights legislation. These legitimate providers display their licensing information prominently and maintain transparent business operations.

Illegal IPTV services typically operate without proper licenses, offer suspiciously low pricing for premium content, and may distribute pirated material. Using unlicensed IPTV services can result in legal consequences for both providers and users, including fines up to 50,000 rubles for individuals and criminal charges for commercial-scale piracy operations.

User responsibilities include verifying provider legitimacy before subscribing and reporting suspected illegal services to authorities. Legitimate IPTV Russia providers offer customer support, official websites, and transparent billing practices. Users should be cautious of services promoted through social media channels or requiring cryptocurrency payments.

Regulatory compliance for IPTV providers includes content quotas (50% Russian programming during prime time), data localization requirements, and regular reporting to Roskomnadzor. These regulations ensure that IPTV Russia services support domestic content production and comply with national security requirements.

International content licensing must comply with Russian copyright laws and international agreements. Legitimate providers obtain proper licensing for foreign content, while illegal services may distribute copyrighted material without authorization. Users accessing properly licensed international content through legitimate IPTV Russia services face no legal risks.

How Much Does IPTV Russia Cost?

IPTV Russia pricing varies significantly based on channel selection, video quality, and additional features. Basic packages from major providers typically cost 299-450 rubles monthly and include 50-100 channels with standard definition quality. These entry-level packages usually feature popular Russian channels, news programming, and basic entertainment content.

Premium IPTV packages range from 699-890 rubles monthly and offer 200-400 channels, HD/4K quality, sports packages, and extensive on-demand libraries. Premium subscriptions often include international channels, exclusive content, and advanced features like multi-device streaming and cloud DVR functionality.

Additional costs may include equipment rental (150-250 rubles monthly), installation fees (1,500-3,000 rubles), and premium channel add-ons (199-349 rubles monthly). Some providers offer equipment purchase options that eliminate monthly rental fees but require upfront investments of 3,000-5,000 rubles.

Promotional pricing for new subscribers can reduce costs significantly during introductory periods. Most IPTV Russia providers offer 3-6 month discounts of 30-50%, allowing users to evaluate services at reduced rates. Annual subscription discounts typically provide 15-25% savings compared to monthly billing.

Bundle packages combining internet, television, and mobile services offer the best value for comprehensive telecommunications needs. These bundles can reduce total monthly costs by 25-40% compared to separate service subscriptions while simplifying billing and customer service interactions.

What Internet Speed Do I Need for IPTV Russia?

Minimum internet speeds for IPTV Russia services depend on video quality and simultaneous stream requirements. Standard definition (SD) content requires 3-5 Mbps per stream, while high definition (HD) streaming needs 8-12 Mbps per stream. Ultra-high definition (4K) content demands 25-35 Mbps per stream for optimal quality.

Multiple device considerations multiply bandwidth requirements substantially. A household with three simultaneous HD streams requires 25-35 Mbps total bandwidth, while 4K streaming on multiple devices may need 75-100 Mbps. Most providers recommend internet speeds 20-30% higher than theoretical minimums to account for network overhead.

Network congestion impact during peak hours (7-11 PM) can affect streaming quality even with adequate bandwidth. Users in densely populated areas may experience more congestion-related issues, making higher-speed internet plans advisable for consistent IPTV Russia performance.

Connection type recommendations favor fiber-optic internet for optimal IPTV performance. Fiber connections provide consistent speeds, low latency, and high reliability compared to DSL or cable internet. Most major Russian cities have extensive fiber-optic coverage from providers like Rostelecom, MTS, and Beeline.

Upload speed requirements are minimal for IPTV consumption (1-2 Mbps) but become important for interactive features and mobile device synchronization. Households using video calling or cloud storage services may need higher upload capabilities to avoid conflicts with IPTV streaming.

Can I Watch IPTV Russia on Multiple Devices?

Multi-device support is a standard feature of most IPTV Russia services, though specific limitations vary by provider and subscription tier. Basic packages typically allow 2-3 simultaneous streams, while premium subscriptions may support 5-10 concurrent connections across different devices and locations.

Device compatibility includes smart TVs, set-top boxes, smartphones, tablets, computers, and gaming consoles. Most IPTV Russia providers offer dedicated applications for iOS, Android, Windows, macOS, and popular smart TV platforms. Web browser access provides additional flexibility for devices without dedicated applications.

Account sharing policies vary among providers, with some allowing family members to use shared credentials while others require separate user profiles. Commercial account sharing or reselling is typically prohibited and may result in service termination. Users should review terms of service to understand acceptable usage policies.

Streaming quality optimization automatically adjusts based on device capabilities and network conditions. Mobile devices may receive lower resolution streams to conserve bandwidth, while large-screen TVs can access full 4K quality when available. Users can often manually adjust quality settings based on their preferences and network limitations.

Synchronization features allow users to start watching content on one device and continue on another without losing their viewing position. This functionality is particularly useful for mobile viewing during commutes or travel, enabling seamless transitions between home and portable viewing experiences.

How to Cancel IPTV Russia Subscriptions?

Cancellation procedures for IPTV Russia services typically involve contacting customer support through phone, email, or online chat systems. Most providers require 30-day advance notice for subscription cancellations, though some offer immediate termination options with potential early termination fees.

Online account management portals allow subscribers to modify or cancel services independently without contacting customer support. These self-service options are available 24/7 and provide immediate confirmation of cancellation requests. Users should save confirmation emails or screenshots as proof of cancellation requests.

Refund policies vary significantly among IPTV Russia providers. Some companies offer prorated refunds for unused subscription periods, while others may not provide refunds for partial months. Annual subscription cancellations may be subject to different refund terms than monthly subscriptions.

Equipment return requirements apply to rented set-top boxes and other provider-owned devices. Subscribers typically have 14-30 days to return equipment in good condition to avoid additional charges. Some providers offer prepaid return shipping labels, while others require subscribers to arrange and pay for return shipping.

Alternative service migration assistance may be available from new providers when switching IPTV Russia services. Some companies offer to handle cancellation procedures with previous providers as part of their customer acquisition process, simplifying the transition for new subscribers.

Final billing considerations include ensuring all outstanding balances are paid and understanding any potential charges for early termination or unreturned equipment. Subscribers should monitor their accounts for several months after cancellation to verify that recurring charges have stopped and address any billing discrepancies promptly.

Conclusion: Choosing the Right IPTV Russia Service

Key Factors to Consider

Budget considerations should be the starting point for selecting an appropriate IPTV Russia service, as pricing varies significantly across providers and package tiers. Consumers should evaluate not only monthly subscription costs but also equipment fees, installation charges, and potential promotional pricing that may increase after introductory periods. Creating a comprehensive budget that includes all associated costs helps avoid unexpected expenses and ensures sustainable long-term service affordability.

Content preferences play a crucial role in provider selection, as different IPTV Russia services excel in various programming categories. Sports enthusiasts should prioritize providers with comprehensive sports packages and exclusive broadcasting rights, while families with children might value services with extensive educational and family-friendly content libraries. International content availability becomes important for expatriate communities or viewers interested in foreign programming.

Technical requirements must align with household infrastructure and device capabilities. Users with limited internet bandwidth should focus on providers offering adaptive streaming quality and efficient compression technologies. Households with multiple viewing devices need services supporting adequate simultaneous streams, while tech-savvy users might prefer platforms with advanced features like 4K streaming and smart home integration.

Geographic coverage affects service availability and quality, particularly for users in rural or remote areas. Urban residents typically have access to all major IPTV Russia providers with full feature sets, while rural users may need to prioritize providers with strong regional coverage and satellite internet compatibility. Regional content preferences may also influence provider selection based on local programming availability.

Customer support quality becomes critical when technical issues arise or service modifications are needed. Providers offering 24/7 support, multiple contact methods, and comprehensive online resources typically provide better user experiences. Reading customer reviews and testing support responsiveness during trial periods can help evaluate service quality before committing to long-term subscriptions.

Future-proofing considerations involve selecting providers investing in emerging technologies and infrastructure improvements. Services supporting 4K streaming, mobile applications, and interactive features are better positioned to meet evolving viewer expectations. Providers with strong financial backing and strategic partnerships are more likely to continue service improvements and maintain competitive offerings.